The Complete Guide to Pakistan’s Prize Bond Draw: Your Ticket to Surprise Wealth

Published: 1 Jan 2026

Imagine a savings plan where your money is always safe and accessible, but every few months it gets entered into a cash prize lottery with crores of rupees at stake. That’s Pakistan’s Prize Bond Draw—a unique hybrid of a risk-free national savings scheme and an exciting game of chance, unlike regular bank deposits that only offer fixed, often low returns. While investing in stocks or property requires expertise and carries risk, Prize Bonds offer everyday citizens a secure way to participate in life-changing draws, turning routine savings into moments of thrilling possibility administered by the Central Directorate of National Savings (CDNS).The Complete Guide to Pakistan’s Prize Bond Draw: Your Ticket to Surprise Wealt

It include following topics and can be search by under following titles:-

The Complete Guide to Pakistan’s Prize Bond Draw (2026): How to Win Big

Pakistan Prize Bond Draw Explained: A Complete Step-by-Step Guide

How Pakistan’s Prize Bond System Works + Tips to Increase Your Chances

Prize Bond Draw Pakistan: Ultimate Guide for Winners & Investors

Everything You Need to Know About Pakistan Prize Bond Draws (2026)

Pakistan Prize Bond Draw Rules, Results & Winning Strategies

Prize Bond Guide Pakistan: Your Ticket to Winning Wealth

Prize Bond Tips & Tricks: Winning Strategies for Pakistan Prize Bonds

Pakistan Prize Bond Draw Dates, Results & How to Participate

2026 Pakistan Prize Bond Draw Guide: From Basics to Winning Tips

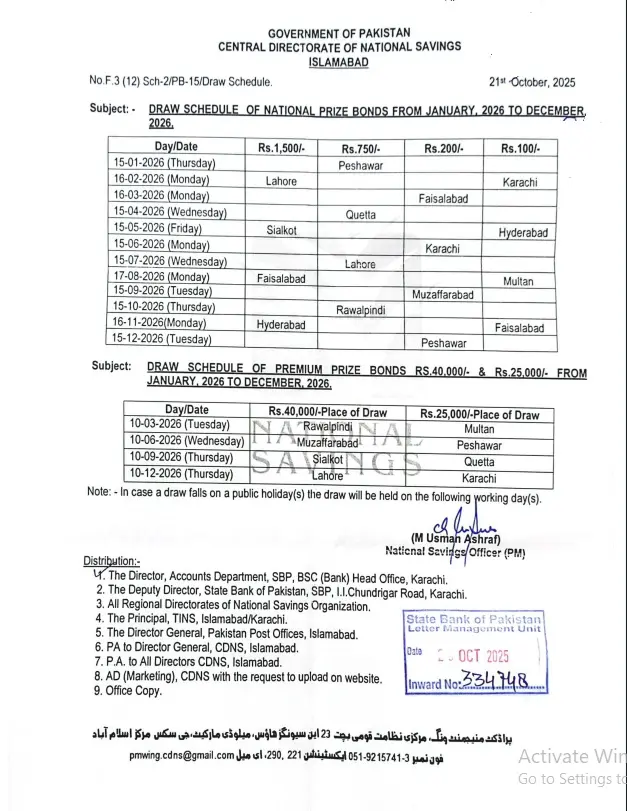

Prize bond draw schedule for year 2026

The Complete Guide to Pakistan’s Prize Bond Draw

Pakistan’s Prize Bond scheme is a flagship financial instrument designed to encourage savings among the public while offering the allure of substantial tax-free prizes. Managed by the State Bank of Pakistan and the Central Directorate of National Savings (CDNS), these bonds are a secure, non-interest-bearing investment. Their sole return comes from the regular computerized draws, where bond serial numbers are randomly selected for cash prizes. The scheme’s brilliance lies in its simplicity and universal accessibility, requiring no formal banking relationship for smaller denominations and providing a tangible sense of participation to millions.

Prize Bond Denominations and Prize Structures

- Rs. 200 Prize Bond: The most common entry-level bond. Its draws are frequent, often held monthly, offering a top prize of Rs. 750,000. This denomination is ideal for first-time investors or those wishing to participate with minimal capital, providing a low-stakes introduction to the system.

- Rs. 750 Prize Bond: A popular mid-tier option. These bonds typically have a top prize of Rs. 1,500,000. They strike a balance between affordable investment and a significantly attractive reward, making them a favorite among regular participants who seek better odds and larger prizes than the Rs. 200 bond.

- Rs. 1,500 Prize Bond: This bond caters to savers looking for higher-value rewards. The top prize for this denomination can go up to Rs. 3,000,000. It represents a more substantial savings commitment with correspondingly larger potential returns from the draw.

- Premium Prize Bonds (Rs. 25,000 & Rs. 40,000): These are the premier investment instruments within the scheme. The Rs. 25,000 bond offers a top prize reaching Rs. 50,000,000, while the Rs. 40,000 bond features a staggering top prize of Rs. 75,000,000. These bonds are designed for high-net-worth individuals and institutional investors seeking the maximum possible return through the scheme.

- Key Feature of Premium Bonds: A critical distinction for Premium Bonds (Rs. 25,000 and Rs. 40,000) is the mandatory requirement to provide the buyer’s Computerized National Identity Card (CNIC) details at the time of purchase. This links the bond to the owner, adding a layer of security and compliance with stringent financial regulations.

- Multiple Prize Tiers: Each draw isn’t just about the jackpot. For every denomination, there are hundreds of second, third, and consolation prizes. This multi-tier structure ensures that many participants win smaller amounts, keeping engagement high across all investor levels.

- Draw Frequency Variation: It’s important to note that Premium Bonds (Rs. 25,000 and Rs. 40,000) typically have quarterly or bi-annual draws, unlike the monthly or bi-monthly draws for smaller denominations. The schedule is officially announced by the CDNS at the start of each financial year.

- Tax-Free Status: A key legal advantage. All prizes won through the Prize Bond draws are 100% exempt from income tax under Pakistani law. This means the advertised prize value is exactly what the winner receives, with no deductions, enhancing the effective return.

- Security Features: Modern prize bonds are high-tech documents. They incorporate holograms, unique serial numbers, intricate patterns, and watermarks to prevent forgery. Premium Bonds often have additional security features to match their higher value.

- Liquidity and Encashment: All bonds, including Premium denominations, can be encashed for their full face value at any authorized commercial bank in Pakistan. There is no maturity period or lock-in, providing complete liquidity for the investor’s principal amount.

- “Prize Bond Draw Pakistan”

- “Prize Bond Results”

- “How to win prize bonds”

- “Prize bond tips”

Official Governing Bodies and Legal Framework

- Central Directorate of National Savings (CDNS): The primary operator. This government department under the Ministry of Finance issues, manages, and conducts the draws for all Prize Bonds. It sets the rules, announces schedules, and distributes winnings, serving as the public-facing authority for the scheme.

- State Bank of Pakistan (SBP): The central regulatory pillar. The SBP provides the overarching financial framework and oversight for the Prize Bond scheme. It authorizes the issuance and ensures the entire process aligns with national monetary policy and security standards.

- Authorized Commercial Banks: The public’s access points. Banks like National Bank of Pakistan (NBP), Habib Bank Limited (HBL), United Bank Limited (UBL), and others act as selling agents. They sell fresh bonds, facilitate encashment of winning bonds, and provide renewal services.

- National Savings Organization: The retail network. With centers spread across major cities and towns, this organization offers another direct channel for purchasing bonds and seeking information. They work in tandem with the CDNS to ensure nationwide reach.

- The Finance Act: The foundational law. Provisions within Pakistan’s annual Finance Act and related statutory rules govern the prize money rates, tax exemptions, and operational guidelines for the scheme. This legal backing guarantees the scheme’s legitimacy and continuity.

- Draw Committee: The guardians of fairness. An independent committee comprising senior officials from the SBP, CDNS, and sometimes a respected judge or auditor supervises each draw. Their presence ensures the computerized random selection is transparent and above board.

- Federal Government Guarantee: The ultimate safety net. All Prize Bonds carry an unconditional guarantee from the Government of Pakistan. This means the face value of the bond is always secure and redeemable, making it one of the safest savings instruments in the country.

- Anti-Money Laundering (AML) Regulations: Compliance is key. For Premium Bonds (Rs. 25,000 and Rs. 40,000), purchasers must provide their Computerized National Identity Card (CNIC) number and details. This aligns the scheme with national and international financial transparency standards.

- Public Notifications: The communication protocol. All official information—draw schedules, results, and policy changes—is disseminated through notifications in leading national newspapers (Dawn, Jang, The News) and on the official CDNS website. This is the only source of verified information.

- Grievance Reprisal System: A mechanism for trust. The CDNS maintains a system to address public complaints regarding non-receipt of prizes or other issues. This formal process, often involving written applications to the directorate, upholds participant confidence in the scheme’s administration.

A Step-by-Step Guide to Purchasing Prize Bonds

Purchasing a Prize Bond in Pakistan is a straightforward process designed for maximum public accessibility. You can choose between physical bonds, which you hold as paper certificates, or newer digital forms registered against your CNIC. The physical purchase requires a visit to an authorized bank or National Savings Center, while the digital method offers modern convenience. Your first step should always be to decide on the denomination that fits your savings goal, as this will determine the investment amount and the potential prize tier you are entering.

How to Buy Physical Prize Bonds from Banks

- Step 1: Locate an Authorized Bank Branch. Not all bank branches sell every denomination. For Premium Bonds (Rs. 25,000 and Rs. 40,000), you must visit a major main branch of an authorized bank like National Bank of Pakistan (NBP). Call ahead to confirm availability.

- Step 2: Prepare the Required Cash. Prize Bonds are a cash-based instrument. You must carry the exact face value amount in Pakistani Rupees for the bonds you wish to purchase. For example, to buy one Rs. 40,000 Premium Bond, you need Rs. 40,000 in cash. Personal checks or card payments are generally not accepted.

- Step 3: Provide Your CNIC Details (Mandatory for Premium Bonds). For all Premium Bond (Rs. 25,000 & Rs. 40,000) purchases, it is compulsory to provide your original Computerized National Identity Card (CNIC) and a photocopy. The bank will record your CNIC number on the bond and receipt, linking it to you.

- Step 4: Fill Out the Application Form. The bank officer will provide you with a simple Prize Bond purchase application form. You need to fill in your personal details, including name, address, CNIC number, and the number and denomination of bonds you are buying. Ensure all information matches your CNIC.

- Step 5: Receive and Verify the Bond Certificates. After payment, the bank officer will hand over the physical prize bond certificates. Immediately check the denomination, serial number, and issue date on each bond. For Premium Bonds, verify that the security features are complex and intact.

- Step 6: Secure Your Payment Receipt. The bank will give you an official payment receipt or a counterfoil. This document is crucial, especially for Premium Bonds. It serves as proof of purchase and is necessary if there is any discrepancy. Store it separately from the bonds themselves.

- Step 7: Safely Store Your Bonds. Treat prize bonds like cash or bearer bonds. Premium Bonds, given their high value, should ideally be stored in a bank locker. For other denominations, use a secure, dry, and fireproof place at home. Keep a separate record of all serial numbers.

- Tip for Bulk or Premium Purchases: If you are purchasing multiple Premium Bonds or a large number of bonds, it is mandatory to inform the bank branch in advance. They must comply with AML regulations and may require additional documentation for large cash transactions.

- Understanding the “Bearer” Nature: Remember, physical prize bonds are bearer instruments. This means whoever physically holds the bond certificate is considered its owner and can claim the prize. This underscores the critical importance of keeping them absolutely secure, especially Premium Bonds.

- Post-Purchase Check: A few days after purchase, you can optionally verify the authenticity of your bond serial numbers by checking them against any recently published draw results list. This confirms the bonds are active and registered in the CDNS system for upcoming draws.

How to Register for and Buy Digital Prize Bonds

- Prerequisite: Your CNIC and Mobile Phone. To buy digital bonds, you must have a valid Pakistani CNIC and an active mobile phone number registered in your name. The phone number is essential for receiving one-time passwords (OTPs) and confirmation alerts.

- Step 1: Visit the CDNS Digital Portal. Go to the official Central Directorate of National Savings (CDNS) website and look for the digital prize bond portal or the “CDNS Mobile App” section. This is the only authorized platform for digital bond transactions.

- Step 2: Create a Digital Investor Account. Click on the registration option. You will be asked to enter your 13-digit CNIC number, full name as per CNIC, date of birth, and mobile number. The system will send an OTP to your mobile for verification to create your secure login.

- Step 3: Complete Biometric Verification (Essential for Premium). For full KYC (Know Your Customer) compliance, especially to enable Premium Digital Bond purchases, the system will require biometric verification. This can be done at a designated NADRA e-Sahulat center or an authorized bank branch.

- Step 4: Navigate to the Prize Bond Purchase Section. Once your digital account is fully verified, log in and find the menu option for “Purchase Prize Bonds”. The portal will display all available denominations, including Rs. 25,000 and Rs. 40,000 Premium Bonds, for digital purchase.

- Step 5: Select Denomination and Quantity. Choose from Rs. 200, Rs. 750, Rs. 1,500, Rs. 25,000, or Rs. 40,000 digital bonds. Select the Premium Bond option and enter the quantity. The system will show the total amount payable.

- Step 6: Choose Your Payment Method. The digital portal integrates with 1Link for Interbank Fund Transfer (IBFT). You will be redirected to a secure payment gateway where you can select your bank and approve the payment directly from your online banking account.

- Step 7: Confirm the Transaction. After successful payment, the CDNS system will instantly credit the digital bonds to your online portfolio. You will receive a confirmation SMS and email with a transaction ID and the bond serial numbers allocated to you.

- Step 8: Access Your Digital Portfolio. Your purchased bonds are now securely held in your digital account. You can log in anytime to view your holdings, see the list of serial numbers, and check their status for upcoming draws. There are no physical certificates to lose.

- Major Advantage: Automatic Participation and Security. The biggest benefit of digital bonds is that they are automatically enrolled in every subsequent draw and are non-transferable and permanently linked to your CNIC. This is particularly valuable for securing high-value Premium Bond investments.

- Security of Digital Bonds: Digital bonds are far more secure against loss or theft than physical ones. For Premium Digital Bonds, this security is paramount. Only you, through your secure login, can operate them, and prizes are directly credited to your registered bank account.

Checking Prize Bond Draw Results and Claiming Prizes

The moment of truth in the Prize Bond scheme is the draw and the subsequent prize claim process. The CDNS conducts computerized, transparent draws for each denomination on a pre-announced schedule. Finding out if you’ve won is simple and can be done through multiple channels. If you are lucky, claiming your prize is a systematic procedure designed to verify ownership and prevent fraud, ensuring the right person gets the money securely and efficiently.

Official Channels to Check Draw Results

- Method 1: Official CDNS Website. The most reliable and fastest source. After a draw is conducted, the Central Directorate of National Savings uploads the complete list of winning serial numbers in PDF format on its official website (www.cdns.gov.pk). You can download the list and search for your bond numbers.

- Method 2: Major National Newspapers. As a public service, the results are published in the classified/advertisement sections of leading newspapers like Dawn, Jang, The News, and Nawa-i-Waqt, usually the day after the draw. Look for the heading “Prize Bond Draw Results.”

- Method 3: Designated Bank Branches. Authorized bank branches, especially major branches of the National Bank of Pakistan, often display the winning lists on their public notice boards. You can visit and check the posted lists manually.

- Method 4: SMS Inquiry Service. The CDNS operates an official SMS service. You can send your 12-digit Prize Bond serial number via SMS to a designated shortcode (like 666). You will receive an automated reply stating whether that bond has won a prize and in which draw.

- Method 5: Prize Bond Draw Result Mobile Apps. Several verified third-party mobile applications (available on Google Play Store) aggregate draw results. They allow you to search by serial number or browse lists by denomination and draw date. Ensure the app is reputable and updated.

- Method 6: Television and Radio Announcements. Some news channels and radio stations announce the major prize winners (first prizes) as a news item following the draw. This is common for Premium Bond jackpot winners due to the large prize amount.

- Method 7: Direct Inquiry at National Savings Centers. You can visit your nearest National Savings Center with your bond serial numbers. An officer can look up the official result database and immediately tell you if your bond is a winner.

- Method 8: Bank Teller Inquiry. When you go to a bank to encash a bond, the teller’s first step is to check the bond’s status in their system. If you’re unsure, you can politely ask them to verify if a bond is a winner before proceeding with any other transaction.

- Method 9: Subscribing to Official Alerts. If you have digital bonds, ensure your contact information is updated in your CDNS digital account. The department may send direct SMS or email notifications to digital bond winners, providing a seamless notification experience.

- Important Verification Tip: Always cross-reference from at least two official sources. For example, check the CDNS website and then confirm via SMS. This eliminates any chance of error or misinformation from unofficial sources, giving you complete confidence in the result.

Process for Encashing a Winning Prize Bond

- Step 1: Locate the Winning Bond and Your CNIC. First, physically retrieve the winning prize bond certificate. Then, take your original, valid Computerized National Identity Card (CNIC). For Premium Bonds recorded with a CNIC, the name must match.

- Step 2: Go to Any Authorized Bank Branch. You are not restricted to the branch where you bought the bond. You can encash a winning prize bond at any branch of an authorized commercial bank across Pakistan. For large Premium Bond prizes, visiting a main branch is advisable.

- Step 3: Fill Out the Prize Bond Encashment Form. The bank will provide a specific “Prize Bond Winning Claim Form.” You must accurately fill in your personal details (name, father’s name, address, CNIC number), the bond’s serial number, denomination, and prize amount.

- Step 4: Submit Bond and CNIC for Verification. Hand over the physical prize bond certificate and your original CNIC to the bank officer. They will examine the bond for authenticity and verify the serial number against their internal database of winners. For Premium Bonds, they will also verify the recorded CNIC.

- Step 5: Provide a Copy of Your CNIC. The bank will require a clear photocopy of both the front and back of your CNIC for their records. This is a mandatory step for processing the claim and complying with State Bank regulations regarding large cash disbursements.

- Step 6: Affix Your Signature and Thumb Impression. On the encashment form, you will need to provide your signature and a thumb impression in the designated spaces. The bank will compare this with the one on your CNIC and potentially against the purchase record for Premium Bonds.

- Step 7: Receive Your Payment. For smaller prizes, banks may disburse cash. For large prizes, especially from Premium Bonds, the bank will issue a Pay Order or Bank Draft in your name for security reasons. You can then deposit this into your account.

- Step 8: For Digital Bond Prizes. If you won with a digital bond, the process is automatic. The prize money is directly credited to the bank account you linked with your CDNS digital portfolio. For Premium Digital Bond wins, you will receive a direct credit and an official notification.

- Step 9: Tax Exemption Documentation. While the prize is tax-free, for very large amounts (typically Premium Bond jackpots), the bank may provide you with a “Tax Exemption Certificate”. Keep this for your personal records in case of any future queries.

- Critical Security Advice: From your home to the bank and back, exercise extreme caution, especially for Premium Bond wins. Do not discuss your win publicly. Have someone accompany you. Prefer electronic transfers over cash for large amounts. Inform your bank manager in advance for a smooth, secure process.

Easy way to purchase premium prize bond of denominations Rs: 25000 and 40000

Follow these steps:-

- Go to nearest state bank of Pakistan(SBP). list is given below.

- With a valid your CNIC card

- A account of any bank in Pakistan

- Their they fill your form available from bank or on their website and ask you to come in some days for some process

- Important note :- if your bonds are of less amount they will accept cash from you if you wanted to buy heavy amount then you have to provide cross check of your bank account .Make sure the should be amount equal to your cross check.

Easy way to purchase prize bond of denominations Rs: 200 , 750 and 1500

Follow these steps:-

For other prize bonds GO to Any commercial bank in working days including NBP , stat bank of Pakistan or any bank you can buy 200 , 750 , 1500 without CNIC and bank account number. You can buy them one month before the DRAW Held of specific bond.

Maximizing Your Chances and Strategic Participation

While the Prize Bond draw is fundamentally a game of random chance, participants can adopt smart strategies to manage their investment and slightly influence their experience. The key is to think of it as a disciplined savings plan with a bonus lottery feature, not as a primary investment strategy. By being systematic, you can enjoy the excitement of the draw while maintaining financial prudence and ensuring your capital remains safe and accessible.

Smart Strategies for Prize Bond Investment

- Strategy 1: Define Your Investment Tier. Decide if you are a small-scale saver (Rs. 200, Rs. 750 bonds), a regular investor (Rs. 1,500 bonds), or a high-value investor (Premium Bonds). Your strategy should align with your capital and goals. Premium Bonds are for those prioritizing a shot at the largest jackpots.

- Strategy 2: Focus on Quantity for Smaller Denoms, Quality for Premium. For bonds up to Rs. 1,500, owning more bonds increases your chances of winning any prize. For Premium Bonds, the strategy shifts to participating in the high-stakes draw with a secure, CNIC-linked instrument.

- Strategy 3: Purchase Bonds in Different Draw Cycles. If you buy multiple bonds, try to stagger their purchase over different months. Since each bond is entered into many consecutive draws, staggering ensures your “batch” of bonds doesn’t all age out of the system at the same time.

- Strategy 4: Use Prize Bonds for Goal-Based Savings. Allocate a fixed, small monthly amount from your budget for prize bonds, treating it like a “fun savings” or “dream fund” category. For Premium Bonds, this could be a lump sum annual investment from savings or bonuses.

- Strategy 5: Always Opt for Digital Bonds When Possible. Digital bonds remove the risk of loss, theft, or damage and guarantee automatic renewal. This is the strongly recommended method for holding Premium Bonds due to the enhanced security and automatic prize credit.

- Strategy 6: Reinforce Your Savings with Winnings. If you win a small prize, consider using that prize money to purchase more bonds. This effectively grows your stake in the scheme without dipping into your primary capital, creating a self-sustaining cycle of participation.

- Strategy 7: Maintain Meticulous Records. Keep a dedicated register or digital file listing every bond serial number, its denomination, purchase date, purchase location, and for Premium Bonds, the CNIC used. Update this record immediately after checking draw results.

- Strategy 8: Understand and Track Draw Schedules. Each denomination has its own draw schedule. Premium Bonds (Rs. 25,000 and Rs. 40,000) typically have quarterly or bi-annual draws. Knowing these schedules helps you time your purchases and manage expectations.

- Strategy 9: The “Hold and Hold” Long-Term Approach. Prize bonds do not expire. The longer you hold a bond, the more draws it participates in. Adopt a long-term mindset of holding bonds for years, significantly increasing the cumulative probability of a win. This is key for Premium Bonds.

- Important Reality Check: The most crucial strategy is to never invest money you cannot afford to lose access to. While the principal is safe, it is relatively illiquid compared to a bank account. Premium Bonds represent a significant capital commitment and should be part of a balanced portfolio.

Understanding Tax Implications and Financial Planning

- Core Principle: Prizes are Tax-Free. Under the Income Tax Ordinance of Pakistan, all winnings from Prize Bond draws are 100% exempt from income tax. This applies equally to a Rs. 200 consolation prize and a Rs. 75,000,000 Premium Bond jackpot.

- No Withholding Tax on Encashment: Unlike bank interest, which has withholding tax deducted at source, no tax is deducted when you encash a winning prize bond. You receive the full advertised prize amount, making the effective return very attractive.

- Prize Bonds and Wealth Statement: The face value of prize bonds you own is considered part of your assets when disclosing wealth. A large holding of Premium Bonds significantly impacts your declared wealth but is a legitimate, government-backed asset.

- Inheritance and Gift Tax Considerations: Prize bonds can be gifted or bequeathed to heirs. For Premium Bonds recorded with a CNIC, a transfer may require documentation. There are generally no gift or inheritance taxes on such transfers of movable property.

- Not a Source of Regular Income: For financial planning, it’s vital to categorize prize bonds as a “potential capital enhancement tool,” not a source of regular or passive income. They do not pay dividends or interest, so they should not be relied upon for monthly expenses.

- Impact on Borrowing Capacity: Holding a large portfolio of prize bonds, especially Premium Bonds, can be viewed positively by some lenders as it demonstrates significant savings and asset-building behavior. However, they are not typically accepted as direct collateral for a loan.

- Role in a Diversified Portfolio: For an investor, Premium Bonds should occupy the “safe, liquid, and high-potential speculation” segment of their portfolio. They are safer than stocks, more liquid than property, and carry the speculative chance of a life-changing prize.

- Consulting a Financial Advisor: If you are investing in Premium Bonds or accumulating a significant total value in bonds, it is prudent to discuss this with a certified financial planner. They can advise on the optimal allocation within your overall financial goals and risk tolerance.

- Record-Keeping for Audits: Maintain all purchase receipts, encashment forms, and prize payment proofs permanently. For Premium Bonds, this is critical. In the event of a tax audit, these documents clearly establish the source of your funds as legitimate tax-exempt winnings.

- Secondary Market for Premium Bonds: The informal secondary market exists but is highly sensitive for Premium Bonds. Any transaction must be handled with extreme care, proper legal documentation, and awareness that the CNIC linkage complicates transfer of future prize claims.

FAQ About The Complete Guide to Pakistan’s Prize Bond Draw

Premium Prize Bonds refer to the Rs. 25,000 and Rs. 40,000 denominations. They are different because they offer the highest jackpot prizes (up to Rs. 75,000,000), require mandatory CNIC registration at purchase for transparency and security, and typically have less frequent draws (quarterly/bi-annual) compared to monthly smaller bonds.

This is a serious situation due to the high value. Immediately file a First Information Report (FIR) at your local police station. Then, with a copy of the FIR and your original CNIC/purchase receipt, visit the main branch of the bank where you bought it and the regional CDNS office. While replacement is not guaranteed, this official report can help block the serial number from being encashed by someone else. This risk is eliminated with Digital Premium Bonds.

Yes, absolutely. The CDNS digital portal fully supports the purchase of Premium Bonds. You must first complete a full biometric verification for your digital account. Once verified, you can select these denominations, pay via interbank transfer, and the bonds will be securely held in your digital portfolio, eliminating physical loss risk.

For a large Premium Bond jackpot, the bank will not disburse cash. They will issue a Pay Order or Bank Draft for security reasons. This process at the bank may take 24 to 72 hours after all verification is complete. If you hold a winning Digital Premium Bond, the amount will be directly credited to your linked bank account within 3-5 working days of the draw.

The core process is the same, but with enhanced scrutiny. Along with the bond and CNIC, the bank will carefully verify that the claimant’s CNIC matches the one recorded at purchase (for bonds bought post-CNIC requirement). They may involve a senior manager for authorization. It is advisable to contact the bank’s main branch beforehand to ensure a smooth process for such a high-value transaction.

Yes, it is still perfectly valid. These bonds remain eligible for encashment of their face value at any bank. You should also check their serial numbers against all past draw results (via SMS or online) to see if they ever won an unclaimed prize. You can continue to hold them or encash them.

Unclaimed prizes, from any denomination, remain with the Central Directorate of National Savings (CDNS). These funds are utilized by the government. There is no time limit for claiming, so a winning Premium Bond can be claimed even years later if the physical bond is presented.

There is no legal upper limit on the number. However, for large purchases, banks are required by law to report large cash transactions and perform enhanced Due Diligence under Anti-Money Laundering (AML) rules. You must provide your CNIC and may be asked about the source of funds.

The official annual draw schedule for all bonds, including Premium Bonds, is published on the Central Directorate of National Savings (CDNS) official website (www.cdns.gov.pk) at the start of each financial year. It is also announced via press release in major newspapers like Dawn and Jang.

It depends on your goal. One Rs. 40,000 bond gives you one chance at the Rs. 75,000,000 jackpot. Multiple smaller bonds (e.g., 80 bonds of Rs. 500) give you more chances to win smaller prizes. The former is a high-stakes, low-probability strategy; the latter is a lower-stakes, higher-frequency strategy. Most advisors suggest a mix based on your capital.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks